Since the launch of Google Smart Shopping followed by Performance Max campaigns, it’s become common for eCommerce brands to segment product groups by margins. As a matter of fact, this tactic isn't new. It started with Standard Shopping campaigns and in the old days of Adwords, with certain types of search campaigns.

But those days are in the past and I think we should leave them there. Here's why.

Segmenting eCommerce Data Feeds for Margin is Inefficient & Encourages Bad Decisions

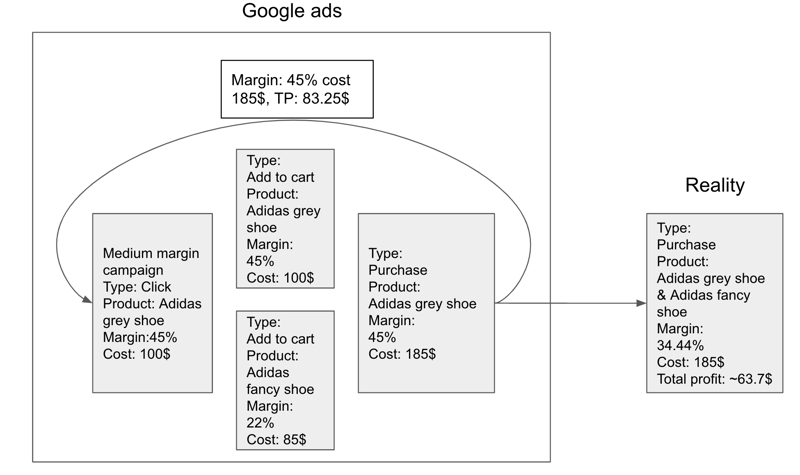

In short I think you’re ultimately fooling yourself - the reason: cross-selling and upselling. When you cross-sell or up-sell a product, it will have different (better) margins. It is difficult to segment these properly within a margin-based segmentation structure, which leads to misleading reporting and thus, poor budget decisions.

When an upsell or cross-sale happen, the reported revenues end up on the entry-product and not split between the products that were actually sold. For simplicity, let's say you have two products in your store of the same price but one has a 22% margin and the other a 45% margin. You could end up reporting the sale of these two products on the 45% margin, while the reality would be between those two (33.5% margin) given they have the same price.

Consider the Importance of the Whole Basket at Checkout

Given the above scenario, you may start optimizing ad spend and traffic to the entry product. Makes sense. But, if that entry product has a low margin and relies on other products in the cart to achieve your target cart margin/ROAS/revenue, then you may have made a bad decision. Remember, ROAS needs high margins to be profitable.

Your reporting has to include the importance of the other products. Even when performance marketing is your driving factor, you must understand the whole picture of your customer behavior and how the cart mix of products impacts the important metrics.

Closing the Gap Between Margin Reality and Reporting

Bidding decisions in the era of automated campaigns are made on the basis of the returned values from the pixels that are in place for tracking your products. If a value of $185 is given to a product with a margin of 45%, but the actual margin is lower, bad decisions will be made.

"The reality is that the margin of the $185 was 34.44% not 45%. This creates a faulty feedback loop without any possibility of checking the reality."

If we add the equation of keyword/product level attribution for the sale that caused this, the gap between reality and the reporting can of course get even larger.

Use Your own Data to Inform Decisions

Start by pulling a report in Google Analytics (be aware of the potential different channel-attribution system) to check what your cross-sells might be.

Next, utilize Conversions with cart data in Google Ads. This allows you to use your Google Ads tracking pixel to supply Google with IDs that are then matched with your shopping feed. This will give you a good picture of your cross and up-sells and give you a look at your gross-profit.

Next, add COGS (cost of goods sold) into your shopping feed data. Then you have a simple equation for gross profit.

Revenue - COGS = gross profit

Other Segmentation to Consider for eCommerce

The kind of segmentation you need depends on quite a few factors. But generally, think about how you talk about the product in natural language. That's probably how you’d want to segment them based on either campaign or asset groups.

There are some elements on the asset group level that currently can't be used to segment. So you'll want to look to the campaign level for them.

And that could be:

- Auction Insights

- Search vs. Shopping

I often base my product segmentation around some of the following, non-revolutionary segments:

- Brand

- Product type (this may have many levels)

- Sale or not

- Stock clearance products, for budgeting and ROAS setting + potential messaging

- Seasonal or event based products, i.e. winter gear, world cup, etc