The eCommerce landscape shifted dramatically in 2020. In the US alone, eCommerce grew 30% to reach levels not expected until 2022.1 eCommerce also grew 26.3% in Western Europe in 2020.2

That growth isn’t surprising given the global upheaval caused by COVID-19. But eCommerce growth isn’t expected to slow significantly in 2021 either. That’s because COVID wasn’t the only thing that affected the eCommerce landscape in 2020. It may have actually been a catalyst to changes that are here to stay. Those changes pose challenges for eCommerce. They also offer valuable insights for taking advantage of the new opportunities.

Insights the Finch team took away from 2020 include:

- Cross-channel strategies turn lost conversions into revenue

- Set up and strategy matter more than bidding

- The sheer complexity of channel options isn’t slowing down

- Automation is key to adapting quickly and at scale

- Targeting helps companies take advantage of unexpected opportunities

Cross Channel Strategies Turn Lost Conversions Into Revenue

Display advertising’s role as an incredible — and often critical — revenue-driving, cost-saving complement to Google Search and Shopping became super apparent this year.

In 2020, Finch saw that 95% of purchases for Finch clients running display ads tie to view-through conversions. We also saw that display plays a key role in the customer journey for many clients. And that it can turn lost clicks into conversions when used for strategic retargeting.

We found that when the time between a click or impression and the final transaction is more than 20% and involves two or more clicks (a standard purchase path for many eCommerce companies’ customers), there’s an ideal opportunity for retargeting. That retargeting — when done strategically — can drive significant sales at a lower combined cost than search and shopping alone

How significant? For one Finch client, retargeting from display ads drove one-third of its paid advertising revenue at an average cost of sale (ACoS) of 4% compared to an ACoS of 14% for other channels. Using audiences segmented granularly, the Finch Strategic Services team used display ads that effectively targeted those audiences. That effort drove one-third of the company’s paid advertising revenue — revenue that wouldn’t have been realized without those display ads.

There’s huge opportunity in how much revenue can be driven and at a lower cost by including display ads for retargeting in a cross-channel media strategy. Put another way, there’s huge opportunity in going after self-selected, highly targeted potential customers for your specific business by using the cookies in their browsers to re-engage them in the sales process they abandoned.

Look at the opportunity this way, if you have a 3% conversion rate, and buy 100 search and shopping clicks:

- The marketplace makes money on each one of those 100 clicks.

- You make revenue only on the 3% of the clicks that convert.

- 97 clicks are potentially lost to you — clicks you paid the marketplace for.

- With granular retargeting display campaigns, you can turn at least some of those lost clicks into revenue and at a lower cost than if you run more search and shopping ads.

Set Up and Strategy Matter More than Bidding in Today’s eCommerce Landscape

2020 made it obvious that bidding is a commodity and very “yesterday.” In other words, your bidding strategy, even smart bidding, isn’t going to help you win against the competition by itself. Your results might look good, but you’re leaving money on the table.

What will help you maximize your return is if:

- You have the right media mix in place to cover your entire funnel, such as some mix of search, shopping, dynamic campaigns, video, social, and display.

- You use the right attribution model to match your strategy.

- You target the right audience(s).

- You use the right conversion type(s).

- You choose the right ACoS target.

All of those items combine to make up your context. You can’t correctly decide what to pay for a bid without that context. You have to be able to see how brand and non-brand ads at the top of your funnel compare to those at the bottom of the funnel from both a cost and revenue perspective.

For example, if retargeting performs well for you, you may want to be aggressive with non-brand search campaigns. Why? Because you can earn revenue for less spend when your customer hits your retargeting tag.

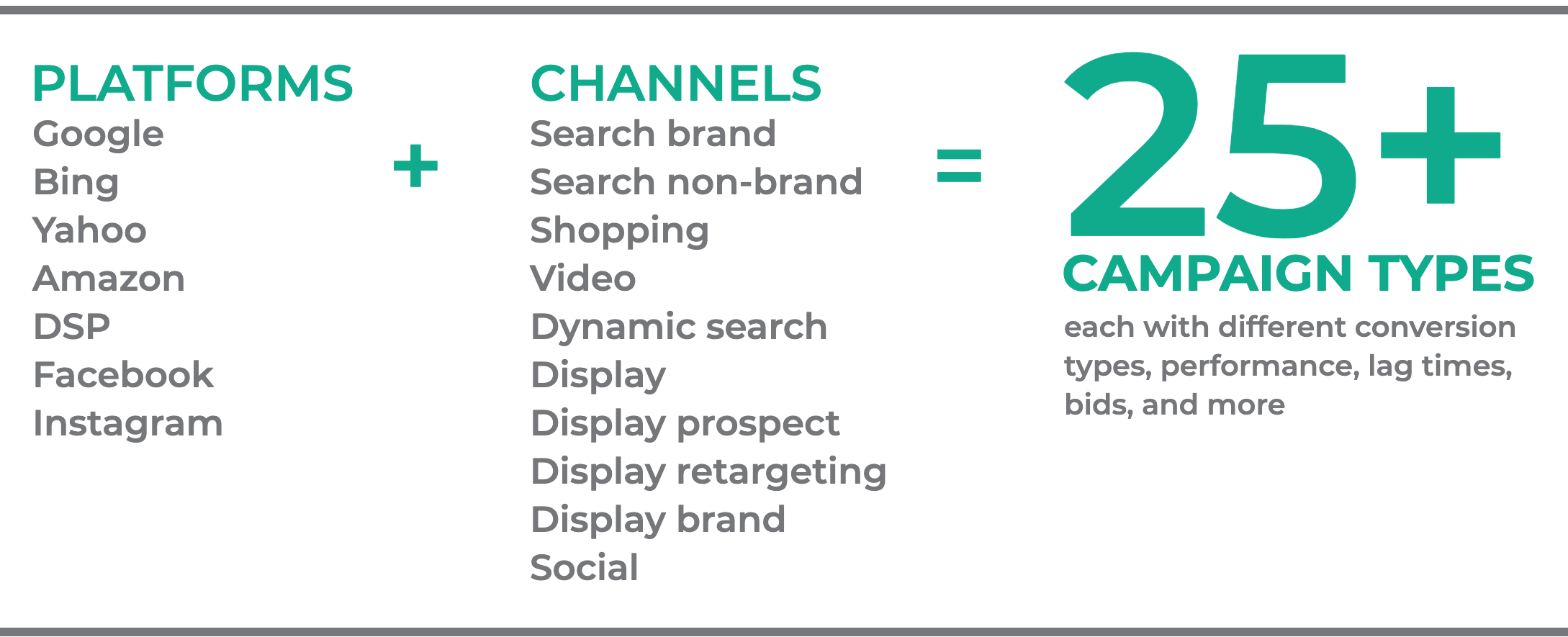

The Sheer Complexity of Channel Options Isn’t Slowing Down

Just 10 years ago, the key pay-per-click (PPC) ad platforms were Google, Bing, and Facebook. Today, those three persist and have been joined by Amazon, DSPs, YouTube, Instagram, TikTok, Pinterest, Snapchat, and more.

Channel options are growing too — they’ve gone from paid search ads to shopping ads, video, social ads, social shopping, voice search, SMS, and more.

The complexity of today’s eCommerce paid media landscape can look like this:

And no one platform or channel is failing. More than 1.79 billion people use Facebook every day.3 And 63% of shoppers start product searches on Amazon.4 If you’re not on all of the key channels, you’re likely missing out on growing your revenue and brand awareness.

And no one platform or channel is failing. More than 1.79 billion people use Facebook every day.3 And 63% of shoppers start product searches on Amazon.4 If you’re not on all of the key channels, you’re likely missing out on growing your revenue and brand awareness.

The challenge: How do you plan campaigns and budgets given all that complexity? How do you ensure you use what works on one platform to optimize on another? How do you make sure you know what’s working, what’s not, and know where to pay more or less as a result? If you focus only on one or two platforms, will you miss out on revenue or get outcompeted?

The opportunity: If you can master it, you can optimize not just one platform or channel, but across them. If you don’t, you leave a lot of revenue on the table. A return on ad spend (ROAS) of 10 or 11 on Google is good, but if you add incremental campaign types, you might do five times better.

This is where Finch can help. Finch specializes in automated data-driven campaign optimization, actionable insights, and strategic workflow management across channels and ad platforms. We do all of that with a single interface backed by strategic consultation and expertise to help you determine the right strategy and execute it.

Automation Is Key to Adapting

Finch believes in automation. Not any automation, but transparent, strategic automation. The Finch team saw an example of the value of automation for adapting this past year.

A Finch client relies on both Finch and a second party for its paid media efforts. When COVID struck and lockdowns started, the client’s sales went up dramatically as they did for many eTailers in 2020.

It was a pleasant — but not unexpected — surprise for Finch that Finch automated campaign optimization let the client realize more sales and more quickly from the Finch-managed campaigns than it realized from the manual approach of the second party.

Targeting Helps Companies Take Advantage of Unexpected Opportunities

Another COVID-inspired finding from the eCommerce landscape in 2020: location targeting’s ability to quickly adapt to market changes and drive sales. A Finch client sells touchless thermometers and, with the Finch platform, Finch was able to quickly implement ads targeted at cities with high COVID case counts. The company drove more thermometer sales and offered a needed item quickly and effectively.

In this case, the client’s Finch CSM used Google Ads data brought into Insights reporting in the Finch Platform to quickly optimize ads for target cities.

Interested in Gaining More for Your eCommerce Landscape?

Contact Finch to talk about how we can help get more from your paid media efforts using the unique mix of Finch expert strategists and the Finch Advertising Management Platform.

1 eMarketer, Insider Intelligence, “US Ecommerce Growth Jumps to More than 30%, Accelerating Online Shopping Shift by Nearly 2 Years,” Oct. 20, 2020

2 eMarketer, Insider Intelligence, “Western Europe Retail Trends 2021,” Jan. 14, 2021

3 Facebook Investor site, “Facebook Reports Third Quarter 2020 Results,” Sept. 2020

4 Statista, “Most popular online marketplaces worldwide in 2019, based on gross merchandise value, Apr. 6, 2020